The Neglect Effect

Growth in a Crowded Market

The Hidden Barrier: The "Neglect Effect"

Many companies, especially micro, small and mid-cap companies struggle with their trading volume, share price and overall visibility. This is not because of leadership nor effort, but a well documented market reality known as "The Neglect Effect". When companies receive less attention from brokers, analysts, and the investing public, their true value is often overlooked, and they remain locked out of Wall Street’s largest capital pools. It’s not your fault - you simply cannot address what you haven’t been shown.

EDUCATION-FIRST

The only REAL Solution

At Acorn Management Partners, we combine real Wall Street expertise with a faith-based, education-first approach. Backed by 15+ years of experience, our proprietary six-step process helps companies expand their shareholder base through a strategic, data-driven outreach supported by clear KPIs, transparency and educating brokers not just on the hype of news but the true story behind your company.

INFORMED GROWTH

A True Strategic Ally in Acorn

At Acorn, we don’t “sell” CEOs and CFOs we empower them. By sharing Wall Street best practices and prioritizing education, we provide the tools and insight to drive sustainable shareholder growth. From plug-in distribution support to full-service communications, our flexible solutions put knowledge and transparency at the center. This allows you to make confident, data-driven decisions that sustain long-term market relevance.

The Challenge

RISKS OF UNDEREXPOSURE

Even Top Innovators Get Overlooked

Wall Street’s brokers control over $4.5 trillion in investor capital, but most public companies never get on their radar - too often overlooked not for lack of merit, but because the market’s gatekeepers are inundated with opportunities and prioritize only the loudest, most consistently communicated stories. If your company isn’t front and center with brokers, you risk missing out on critical capital, market recognition, and sustainable growth.

Key Risks of Underexposure:

- Low Visibility = Low Value

- Companies ignored by brokers and analysts often trade at a discount and see low trading volume.

OVERLOOKED IN A GROWING MARKET

Fragmented Messaging = Missed Opportunities

Bringing inconsistent communication to the public markets is a recipe for disaster. It is our job to help bridge that gap between the message of your company and the investors on wall street.

- Inconsistent communication confuses investors and erodes reputation.

- Without a proactive broker outreach program, companies lose access to new shareholders and major capital pools just through being overlooked or misunderstood.

The Solution

REAL TIME OPTIMIZATION AND A BROKER-DRIVEN RESULT

Direct access to $4.5 trillion+ in broker-controlled capital

Our goal is to place your story in front of the decision-makers that your traditional methods just can't reach. This access to over $4.5 trillion in broker-controlled capital is only accessible through an education-first data-driven approach that involves modeling long-term value through using comparables, catalysts and data based presentations.

- Compelling Investment Education

- Consistent Communication Cadence

- Real-Time Tracking and Optimization

- Hybrid Sales Funnel

Our Process

THE MOST EFFECTIVE PATH TO CAPITAL & SHAREHOLDER GROWTH

Our Approach: Deliberate, Disciplined, and Built for Results

With an asset pool over five times larger than the institutional capital market, broker-controlled assets open up an almost always untapped market for small - micro-cap companies.

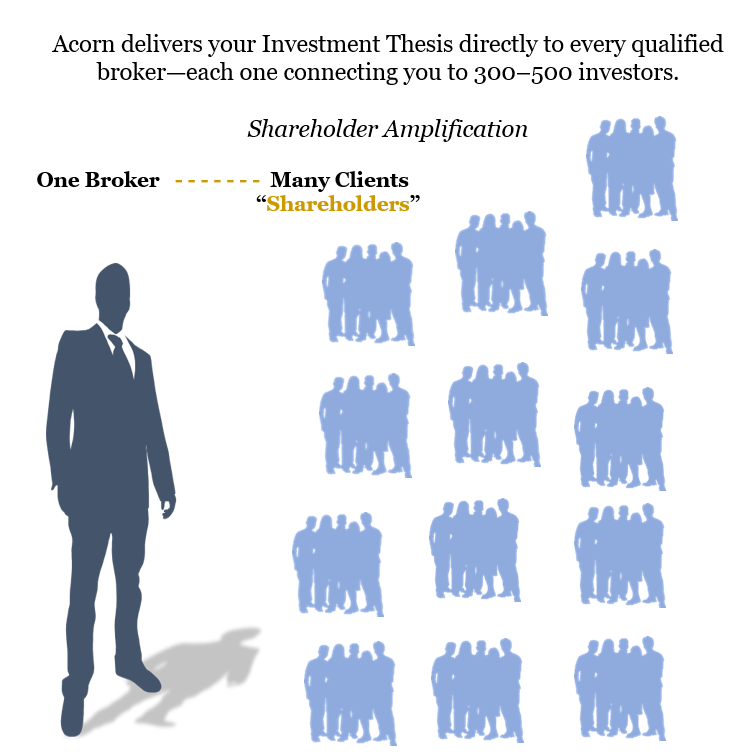

- Extensive Network: We execute over 3,000 targeted outbound calls and 700 broker presentations each month, engaging professionals who collectively influence trillions in assets.

- Broker Impact: Each broker typically manages 400–500 accounts and an average of $305 million in assets.

- Capital Access: For example, a network of just 300 brokers represents $91.5 billion in assets. Even a conservative 0.25% penetration opens the door to $228.75 million in potential capital.

- Shareholder Expansion: Our broker-driven approach fuels real shareholder growth, driving trading volume and market visibility far beyond what traditional IR can achieve.

.png?width=603&height=500&name=img-%20shareholder(2).png)

The Facts

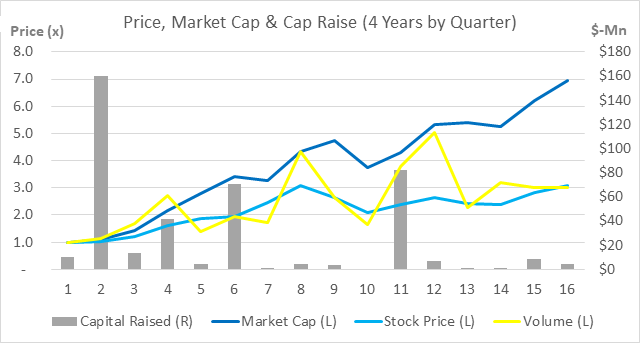

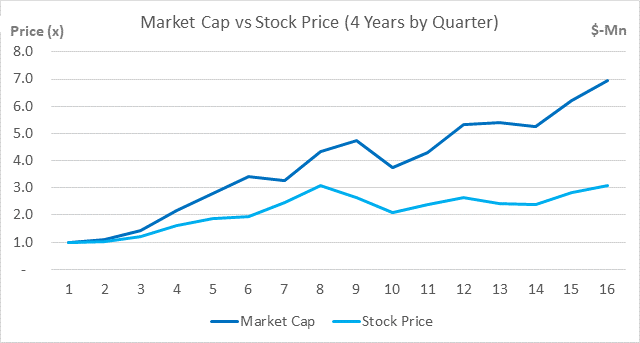

The AMP process has consistently delivered an increase in the number of shareholders, market capitalization, as well as the company’s funding opportunities and institutional ownership. See for yourself by reviewing clients and case studies.

Contact us for more information!

Our Clients

Case Studies

Testimonials

Acorn Management Partners, LLC is an absolute game-changer when it comes to elevating the visibility and awareness of public companies. Their unparalleled expertise and innovative strategies have consistently delivered outstanding results, propelling market awareness to new heights for their clients.

Through meticulous planning and a deep understanding of the ever-evolving landscape, Acorn Management Partners ensures that their clients' stories resonate with advisors, investors, analysts, and stakeholders alike. Their proactive approach not only boosts brand recognition but also fosters trust and confidence within the investor community.

What sets Acorn apart is their unwavering commitment to client success. They go above and beyond to tailor their services to each company's unique needs, providing personalized solutions that drive tangible, measurable outcomes. With Acorn Management Partners in your corner, you can rest assured that your company's message will be heard loud and clear, paving the way for sustained growth and success in the public domain.

I wholeheartedly endorse Acorn Management Partners, LLC to any public company looking to amplify their presence and make a lasting impact in the market.

Brian D. Corday

CEO; BULLBEAR PARTNERS, LLC.

Acorn Management Partners has been an indispensable asset to our IR team.

Their unparalleled expertise and tailored solutions for investor awareness have consistently exceeded our expectations. Their data-first approach to investor communications is unrivaled and Acorn's dedication and professionalism have been instrumental in growing our investor base.

Their team's proactive approach and commitment to understanding our unique challenges have fostered a collaborative partnership that we deeply value and that has significantly contributed to our success.

Without hesitation, we recommend Acorn Management Partners to any organization looking to expand its investor base.

Tony Sklar

Managing Partner; ESG Advisors

.png?width=237&height=75&name=logo%201(1).png)